Does Homeowners Insurance Policy Cover Flooding? A basic condition of flood likewise exists if two properties are impacted, one of which is yours. Flooding insurance covers your home's foundation aspects and devices that's required to support the framework (heater, water heaters, circuit breakers, and so on). Watercrafts may be covered by a different endorsement to a home owner's plan or by a separate boat owner's plan. Some exclusive insurance policy carriers provide flooding insurance coverage, too. While they might set you back more than NFIP coverage, they might offer higher insurance coverage limitations or added coverage. Nonetheless, if your roofing leakages while it is raining, leading to damage to your furnishings, your insurance claim will likely be refuted if the roof covering is old and reveals indicators of neglect. Claim insurers can detect damages that has actually happened slowly gradually and staying up to date with common home maintenance belongs to being a home owner. Damages from wear and tear or deteriorating residential property is a standard property owners insurance policy exemption.

My Car Was Immersed In Flood Water Will The Damages Be Covered By My Vehicle Plan?

Standard home owners, renters, and condominium plans only provide loss of usage and added living expenditures for any type of covered danger. A flooding insurance coverage usually will not go into impact up until 30 days after you acquire the policy. Water damages can trigger severe harm to your home, rapidly totaling thousands of bucks in damage and needing months of repair. You may think it will not occur to you, however no matter where your home lies or how lately it was built, water damage is an extremely genuine opportunity. The perpetrator can range from a blocked drain to a burst pipeline, malfunctioning dishwashing machine, roof covering leakage or something else. If you're not sure whether you have mold protection or the quantity of protection you have, call your insurance agent or business for further descriptions. For example, if slow-leaking pipelines cause damage due to inappropriate maintenance, the insurer will likely deny the insurance claim. Mold, dry rot and leakages that result from neglected pipelines and could have been prevented are not considered mishaps. Lightning strikes can spark fires, damages roofs and smokeshafts, and situation power surges that damages the electrical wiring in your home. Your home insurance plan ought to cover any kind of damage done by lightning strikes. Keep in mind, the amount that your insurance policy provider will certainly pay is capped by your policy's coverage limits. In Illinois, if mold results from water damages adhering to a covered fire or lightning loss, the mold and mildew damages would be covered, and the total of all damages, consisting of the mold and mildew, undergoes the full plan limit. Vandalism is covered by many conventional home insurance coverage, consisting of if your home is burglarized while you're away and rain is available in via the broken door and problems your belongings. For example, claim a tree branch fractures your window and rainfall enters into your home, resulting in mold expanding inside your drywall. Your house owners insurance coverage will certainly more than likely cover the damage due to the fact that the first damage was abrupt and brought on by a covered peril.- When rain in your house is left unaddressed for weeks or months, the damage has a chance to become worse and brand-new troubles can develop.You will require flood insurance if you live in a marked flood zone.Flood damage caused by a cyclone, nonetheless, will certainly not be covered by your plan.Wind damage triggered by storms is among the most typical sorts of insurance claim submitted to insurance provider, and it's covered by most standard homeowners insurance coverage.

What Types Of Water Damages Are Consisted Of In Homeowners' Plans?

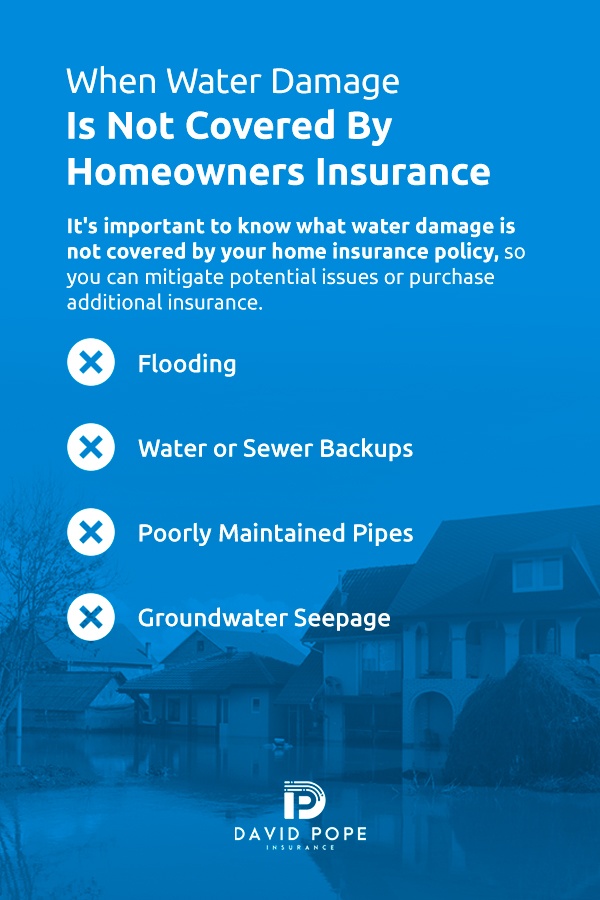

If rain gradually leaks in via a leaking skylight and you try to file a claim for damage that established over weeks or months, your insurance firm will likely hold you in charge of the damage. Bankrate.com is an independent, advertising-supported author and contrast solution. We are made up in exchange for positioning of funded products and services, or by you clicking on specific links posted Automobile attorney on our website. As a result, this settlement might affect just how, where and in what order items show up within noting categories, except where banned by law for our mortgage, home equity and other home borrowing products.What sort of water damage is not covered by home owners insurance coverage?

Flooding is the No. 1 all-natural disaster in the USA, yet house owners insurance coverage does not cover this danger. Primarily, any kind of water that moves right into your home from Deputy attorney the ground isn't covered. So rain, a surging river and saturated ground aren't covered.